The National Identity Management Commission (NIMC) has announced the forthcoming launch of an upgraded national identity card equipped with payment capabilities to facilitate various social and financial services. This initiative, developed in collaboration with the Central Bank of Nigeria (CBN) and the Nigeria Inter-bank Settlement System (NIBSS), will harness the capabilities of AfriGO, a national domestic card scheme.

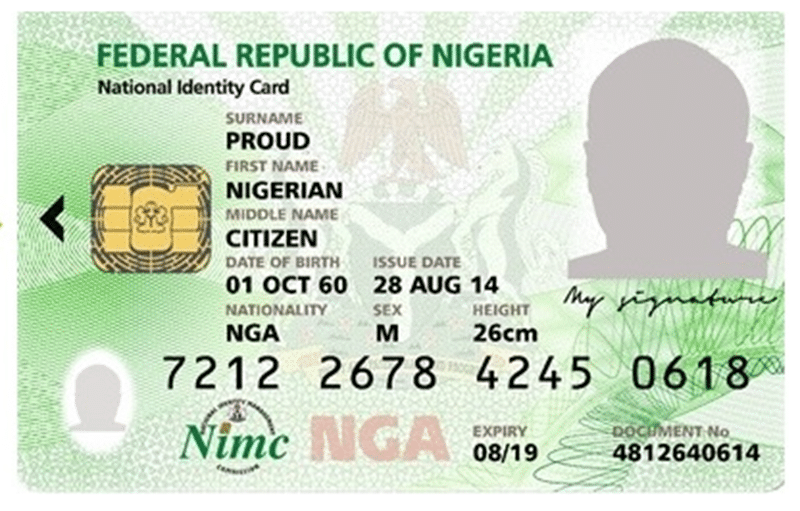

According to Kayode Adegoke, the Head of Corporate Communications at NIMC, the new ID card, fortified with verifiable national identity features, is mandated by the NIMC Act No. 23 of 2007. This legislation empowers NIMC to enroll and issue a General Multipurpose Card (GMPC) to Nigerian citizens and legal residents.

The innovative card is poised to address the need for physical identification, enabling cardholders to validate their identity and access a spectrum of government and private social services. Furthermore, it aims to foster financial inclusion among marginalized segments of the population, empowering individuals and fostering greater engagement in national development endeavors.

Eligibility for the new card is contingent upon registration with the National Identity Number (NIN) system, ensuring that only registered citizens and legal residents can avail themselves of its benefits. Aligned with International Civil Aviation Organization (ICAO) standards, the card will serve as the nation’s primary identity card and can also function as a debit or prepaid card by linking it to preferred bank accounts.

In addition to traditional identification features, the card will incorporate a Machine-readable Zone (MRZ) compliant with ICAO e-passport specifications, alongside key data such as the issue date and document number. Moreover, it will encompass a range of additional functionalities, including travel and health insurance information, microloans, agricultural support, food subsidies, transportation benefits, and energy assistance.

The card will be equipped with Nigeria’s Quick Response (NQR) code, containing the national identification number and biometric authentication data, ensuring secure identity verification. Offline transaction capabilities will enable cardholders to conduct transactions in areas with limited network coverage or infrastructure.

The rollout process for the enhanced ID cards will offer multiple avenues for application, including online platforms, commercial banks, participating agencies, and NIMC offices nationwide. NIMC reaffirms its commitment to safeguarding cardholders’ personal data and ensuring compliance with international data security standards to protect user confidentiality and information integrity.

- 08045674546

- info@mediaplusng.com

- Lagos, Nigeria