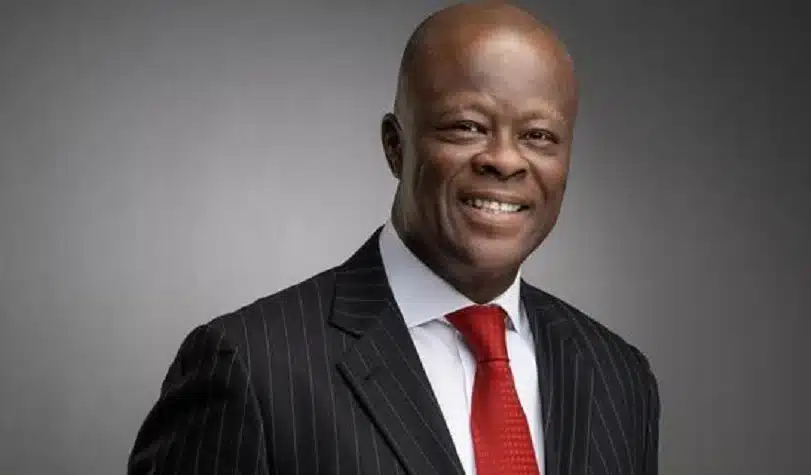

A noteworthy development unfolds as the Federal Government of Nigeria takes strides towards debt settlement, earmarking approximately 4.83 trillion naira from Nigerian Treasury Bills (NTBs) and bonds issued in 2024 to clear outstanding advances from the Central Bank of Nigeria (CBN). The revelation comes from Mr. Wale Edun, Minister of Finance, during a presentation at the Lagos Business School (LBS) Breakfast Club.

This decision underscores the government’s proactive stance in meeting financial commitments and alleviating its debt burden. By deploying funds sourced through NTBs and bonds, the government aims to offset its ways and means advances from the CBN, demonstrating a dedication to fiscal prudence and monetary stability.

Though the total ways and means indebtedness to the CBN surpasses 23 trillion naira, the National Assembly previously greenlit the securitization of 7.3 trillion naira of these advances. This recent allotment signifies a substantial stride towards fulfilling the government’s repayment obligations and assuaging apprehensions regarding the sustainability of its borrowing practices.

The choice to settle the CBN’s ways and means advances through bonds and Treasury Bills mirrors a calculated financial strategy aimed at optimizing the government’s debt portfolio and ensuring sustainable fiscal conduct. By leveraging financial instruments like bonds and NTBs, the government can access capital markets to secure funds for debt settlement while mitigating repercussions on liquidity and interest rates.

This announcement follows remarks made by CBN Governor Mr. Olayemi Cardoso in February, indicating the apex bank’s decision to discontinue ways and means loans to the federal government unless all outstanding balances are reconciled. This underscores the urgency of the government’s actions to address its debt commitments and uphold a harmonious relationship with the central bank.

The repayment of the CBN’s ways and means advances is anticipated to yield significant ramifications for Nigeria’s fiscal terrain, encompassing debt sustainability, liquidity management, and monetary policy efficacy. By curbing reliance on central bank financing, the government can bolster transparency, accountability, and credibility in its fiscal endeavors.

As the government persists in its debt settlement endeavors, stakeholders will vigilantly observe the ramifications on the economy, financial markets, and government finances. Transparency and judicious fiscal stewardship will be pivotal in ensuring the enduring viability of Nigeria’s debt trajectory and fostering economic stability and prosperity in the long haul.

- 08045674546

- info@mediaplusng.com

- Lagos, Nigeria